How to Size a Market - A Step By Step Guide to Methods & Types - Top Down, Bottom Up, Value Capture and TAM, SAM, SOM

Summary

Objective & Scope of Target Market Sizing

-

The objective of target market sizing as an exercise is not to be precise, but to be accurate by order of magnitude. It doesn’t matter if your predicted versus actual target market size difference is $10M but it matters a great deal if that difference is $100M+.

-

Target market sizing is one component of Target Market Strategic Analysis that should ideally give your team some idea as to whether to enter a given market or not.

-

This answer should be informed by the problem you are trying to solve, your existing or prospective customer persons and segments, investment required to enter, and applicable competitive set.

-

This post focuses on the theoretical methods and types of sizing target markets as opposed to the strategic factors that influence market entry, which while referenced here either directly or via implication, will be detailed separately.

-

Said another way, this post assumes that analyzing a given market for entry is desirable to start, and details how to analyze the market.

-

It does not explore whether a market is “good” or “bad” to enter from a strategic standpoint.

Target Market Sizing Calculation Methods

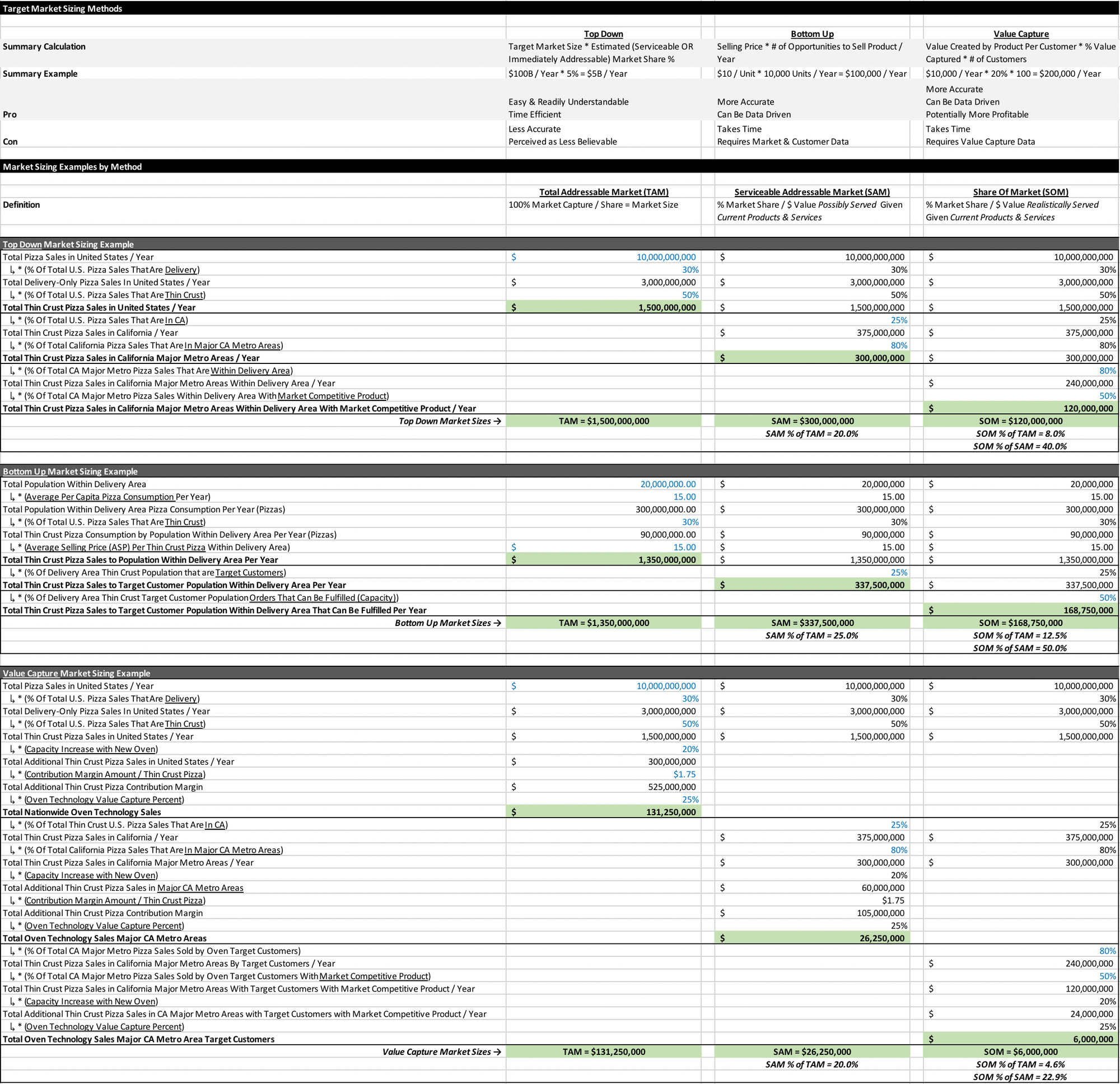

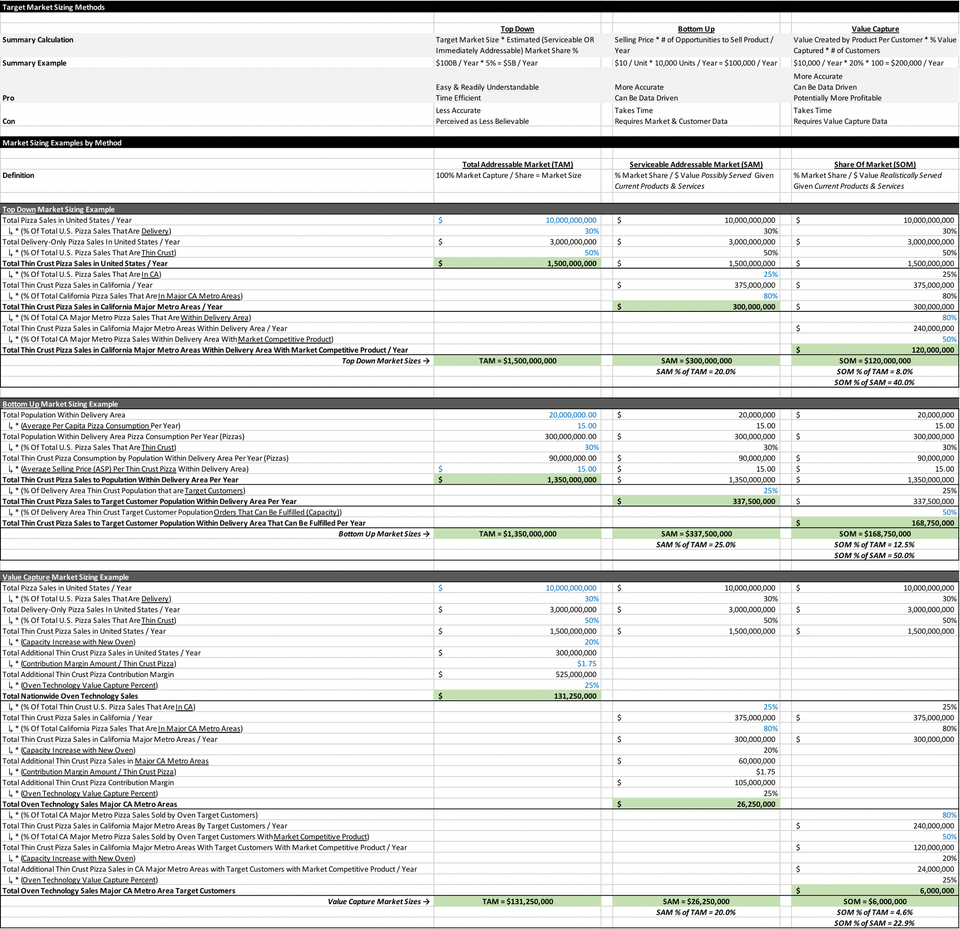

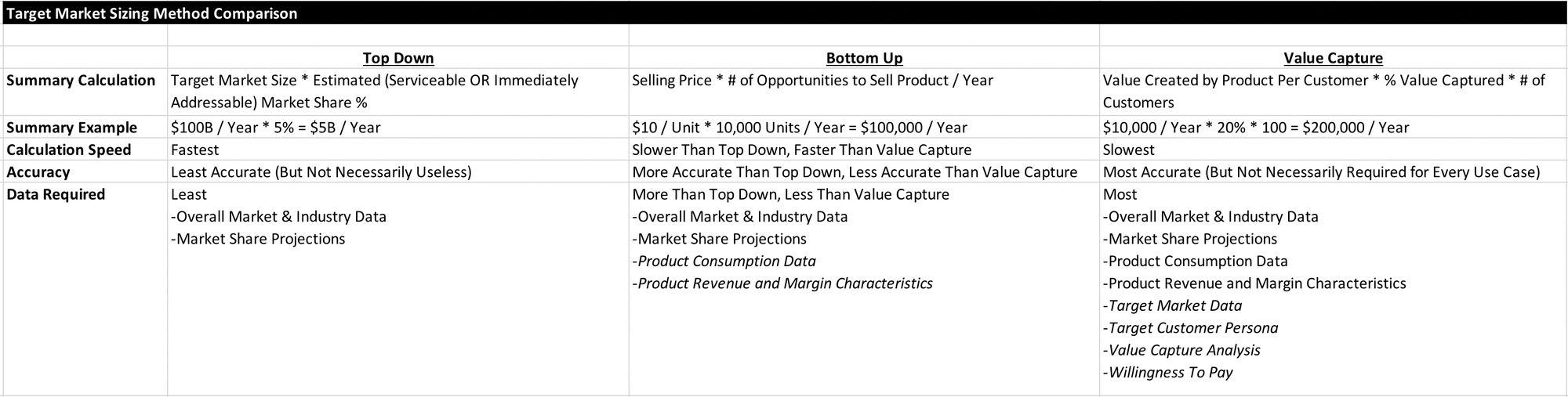

There are three common market sizing methods: top-down, bottom-up and value capture.

Top Down market sizing multiplies overall market size by the market share percentage you believe your team can obtain. It is easy to understand, but generally not very accurate

Bottom Up market sizing is more involved, but generally more accurate than Top Down. It consists of multiplying the potential selling price of the product by the number of opportunities to sell the product, which is further broken out into customer segments.

Value Capture market sizing is sometimes combined with Bottom Up analysis as it centers around calculating the value that your product or service will provide and what percent of that value you can feasibly capture, all multiplied by the number of selling opportunities. Value Capture analysis accuracy can vary significantly depending on what customer pricing data has been collected and data confidence level.

Target Market Type Definitions

There are an infinite number of ways to refer to the different market sizes that we’ll talk about here, but in general, I’ve found the below to be the most readily understandable.

Each of the below types of market sizes can be calculated with any of the above methods.

TAM - Total Addressable Market

TAM assumes you capture 100% of the market and is meant to simply illustrate the entire market size, not what you will ultimately service or capture.

Example - All pizza sales in the United States in a given year are ~$100B.

SAM - Serviceable Addressable Market

SAM is focused on the market share percentage and dollar value that your company could possibly serve given its current products and services.

Example - Our thin crust pizza making company currently operates in California, with a focus on delivery-only in major metro areas. While our TAM remains the same (US Thin Crust Pizza Sales), our SAM is now focused on the pizza delivery market in major metro areas in California.

SOM - Share of Market

SOM is focused on the market share percentage and dollar value that your company could realistically serve given its current products and services today or in the very near future.

Example - Our pizza company operates in a hyper-competitive market and realistically only competes at the high end of the vegan pizza market ($20+ price point per pizza). Our SOM is vegan thin crust pizza buyers that are in CA major metro areas that don’t purchase from our competitors or make their own. Because we are delivery only, our SOM doesn’t include dine-in customers. Currently we only operate in major metros in California, and as a result, our SOM only includes those areas in California.

Detailed Discussion

Market Sizing Question Formulation & Sample Questions

Each of the following can be tested across all market sizing methods and types.

If the format seems familiar to writing product user stories, it is!

Utilize the following format to generate your market sizing question:

- How large is the market in

DOLLARS, CUSTOMERS, WIDGETSin theGEOGRAPHYforCUSTOMER TYPE/PERSONAacrossTIME PERIOD.

Sample Questions

-

How many shared Uber/Lyft rides occur in Florida for 20-30 year olds from 9am-5pm, each month?

-

What is the dollar volume of vending machines in Canadian airports each year?

-

How many units of funnel cake are sold at the Wisconsin state fair each season to fair staff and employees?

Five High Level Market Sizing Steps

-

Determine the Market Sizing Question

-

Utilize the question template above to form your question.

-

Spending time to understand exactly which market you are trying to size can save you substantial time and resources gathering data or building models.

-

-

Gather Industry & Customer Data

-

Independent of which market sizing method or type you will utilize, you will need to gather data on the industry as well as target customers.

-

Overall, data typically falls into three categories: Industry, Customer, and Product.

-

Typical data gathered for Top Down and Bottom Up market analysis include population numbers, total industry sales, and product type segmentation (% of one product vs another product).

-

-

Select Market Sizing Method

- Next, select your market sizing method. This selection can depend on the amount of time one has as well as the data readily accessible.

-

Select Market Sizing Type Required

-

Next, determine the level of analytical depth required.

-

Do you need to know the TAM, SAM, or SOM?

-

Understanding the degree of granularity required can simplify or complicate the analysis substantially.

-

-

Build Model & Calculate

- Finally, combine the data gathered initially with the market sizing method and type selected to create an Excel model detailing the approximate market size.

Common Mistakes in Market Sizing

These mistakes can also be seen as techniques that others may utilize to misrepresent or mischaracterize the size of a given market.

-

Only Presenting the TAM or SAM, Implying it is the SOM

-

If the TAM or SAM were the only market types requested, this is a non-issue, but often in presentations that TAM or SAM are presented as the only market sizes and implied to be the SOM.

-

While presenting the TAM and stating that “the market size for X is

TAM” is not technically false, it is misleading in the sense that if your company were to pursue that product line, the SOM would be the relevant number, not the TAM.

-

-

Child/Sub Market Segments Are Always Smaller Than Their Parent Markets

-

While it may seem obvious, always ensure that sub-markets are smaller than their parent markets.

-

The only exception to this would be if the product or service in question expands the market in some substantial way, but technically, this is simply pulling dollars from another market or use case.

-

This can either be presented as a market expansion exercise or as simply capturing a small percentage of a second, adjacent market.

-

-

Falsely Presenting Market Sizing Analyses as More Accurate and Well Researched than the Data Should Allow

-

No matter how tempting it may be, do not attempt to paper over a lack of research or lack of knowledge regarding unit economics that feed your market sizing.

-

Far better to simply call out the assumptions and outstanding questions than to portray 100% confidence.

-

I have seen this happen dozens of times in presentations or meetings, and as soon as there is a sense that even a single assumption or number is poorly researched or calculated, the entire analysis is called into question, often at the expense of what is overall a reasonable market analysis.

-

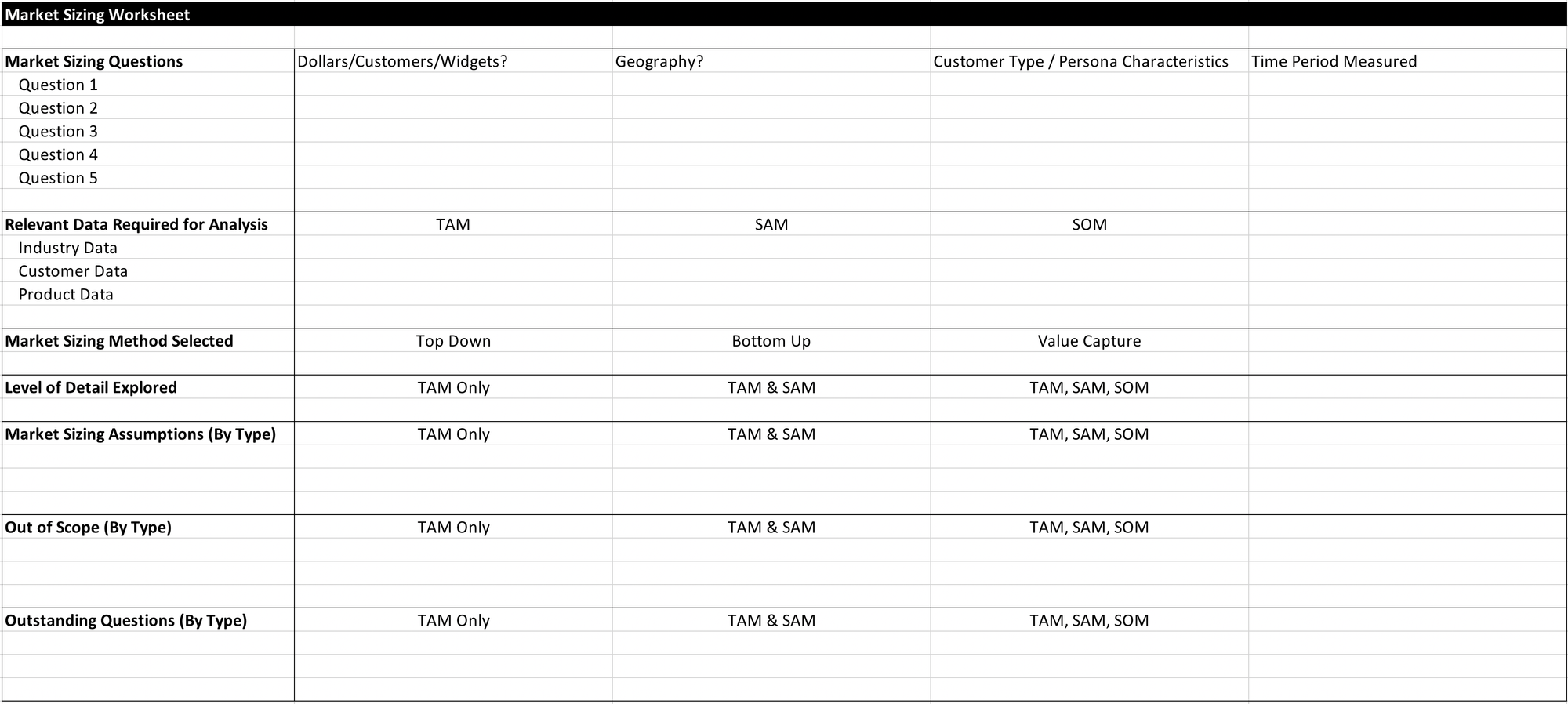

Market Sizing Worksheet

Utilize the market sizing worksheet to start your market analysis, state your question, which type of analysis method you will utilize, along with the data required. The spreadsheet also includes tabs that compare the types of market sizing analysis and a full sample worksheet as well.

- Market Sizing Worksheet

- Comparing Market Sizing Methods

- Sample Market Sizing Model

- Continuing the pizza example from above, the Excel model linked is meant to demonstrate each of the market sizing methods as well as each of the target market types.

- All numbers are fictional and meant to illustrate methodology, not any specific result.