Online Grocery Delivery Shrink Reduction And Profit Contribution

Summary

Topics

Consumer grocery delivery is typically discussed in the context of being a “loss-making” enterprise due to additional labor and delivery costs above and beyond a traditional in-store model without discussing the other potential benefits of a delivery model.

Hypotheses & Questions

Whether the reduction in a concept known as shrink, or product losses due to a combination of theft, spillage, mishandling, poor demand forecasting or other assorted reasons, can outweigh the additional labor and delivery costs imposed by delivery.

Whether a “ghost kitchen” or entirely virtual grocery delivery model, or a hybrid model, is more profitable than in-store only model or can at least contribute to gross or operating margin.

Given how low grocery industry operating margins typically are (~2%), will delivery contribute to, or decrease, an already slim operating margin?

Assumptions

While this post does not explore the overall additional costs of delivery and labor, explored in the references section in depth, it does provide an example utilizing Kroger’s latest financial data of how delivery could successfully contribute an overall net gain to gross and operating margin through shrink reduction.

Additional delivery and labor costs were not explored here as there is very little good public data on delivery costs for online grocery delivery, and the suspected variability in delivery costs for a merchant such as Amazon (that is already making regular consumer deliveries, has their own/partial delivery network) vs a merchant such as Bristol Farms (Gourmet, regional grocery store with no other consumer deliveries) is difficult to estimate and model.

The objective of this analysis was not to examine the cost of delivery, but to explore the potential benefits of delivery in the context of in-store shrink which is typically not discussed or implied to be the same.

In addition, there is a strong possibility that in the next 5-10 years small, autonomous vehicles will reduce delivery costs substantially. That is beyond the scope of this post.

Conclusions

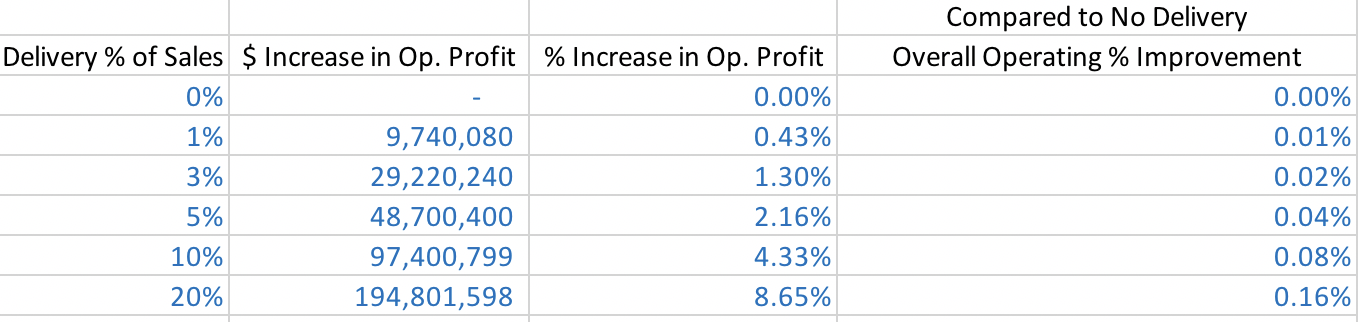

Utilizing Kroger’s current cost structure, with a 5% shift in overall sales to delivery, and a corresponding shrink reduction of ~30% (2.7% Overall Sales to 1.9%), realizes ~2.16% increase in operating profit, or $50m.

Conservative estimates of shrink reductions from Ordering Inefficiencies, Production Planning, Product Handling Errors, Damaged/Unsellable Goods, Scan File Errors, Accounting Errors, Shoplifting, General Theft.

Said another way, under this model, every 1% shift to delivery of overall sales will result in:

- A 0.01% comparative increase in operating margin over no-delivery model.

- A 0.43% improvement in operating profit.

The approximate conclusion that grocery delivery could conceivably be profitable when including shrink reductions is counterintuitive.

The additional conclusion that grocery delivery could be purposefully and specifically utilized to offload goods that are about to expire or that would not traditionally be picked by in-store consumers could result in a higher overall gross margin is also counterintuitive.

In this regard, delivery now becomes a feature for grocery retailers instead of a bug, even with higher return or refund requests.

Detailed Discussion & Examples

Rationale For Investigating Issue

As an avid consumer of online grocery delivery before and during the COVID-19 pandemic, I began to notice a trend that a consistent portion of each order, particularly around fresh produce, was not necessarily as fresh or of as high quality as I would have picked myself.

Anecdotally, based on a very informal survey of friends and family, I’m not alone in this experience. This seems to be a consistent feature of online grocery delivery.

While there is absolutely some portion of this that can be attributed to poor grocery picking ability and the abrupt transition to online grocery delivery for most retailers, I began to wonder if this was by design and the rationale behind that choice.

Particularly in light of the fact that most of the retailers offering grocery delivery will refund the cost of any unsatisfactory items, no questions asked and no return required.

Shrinkage - How Grocery Store Gross Margin Magically Shrinks

Gross and operating margins for grocery retailing have always been extremely slim.

- Gross margins typically sit at 22%.

- Operating margins typically sit at 2% of total sales.

- This can be confirmed by a quick glance at Kroger’s 10k.

Shrinkage, or the costs of products that do not result in a sale for a myriad of reasons, typically measures around 2.7% of total sales.

When contextualized with Operating Margin, this is an incredible number!

According to the latest USDA report I could find from June 2016, average shrink %’s for fruit, vegetables, and meat/poultry/seafood are 12.6%, 11.6%, 12.7%.

Some items have extraordinary shrinkage costs:

- Turnip Greens - 63% (This means more of the product is lost than sold!)

- Papayas - 43%

- Okra - 40%

- Watermelon - 25%

- Shellfish - 24%

- Veal - 23%

- Apples - 19%

- Mushrooms - 17%

To the original motivation for the question, what if grocery retailers could utilize delivery to more effectively manage the goods that might be susceptible to shrinkage?

Even if some portion of those goods are refunded due to consumer complaints, there will be a non-zero portion that will be paid for by the consumer, that do not have to be written off by the retailer.

At scale, if shrink could be reduced by 30% for delivery orders or even more, that could have a material impact on overall gross and operating profits.

Projected Shrink Improvements Resulting from Delivery

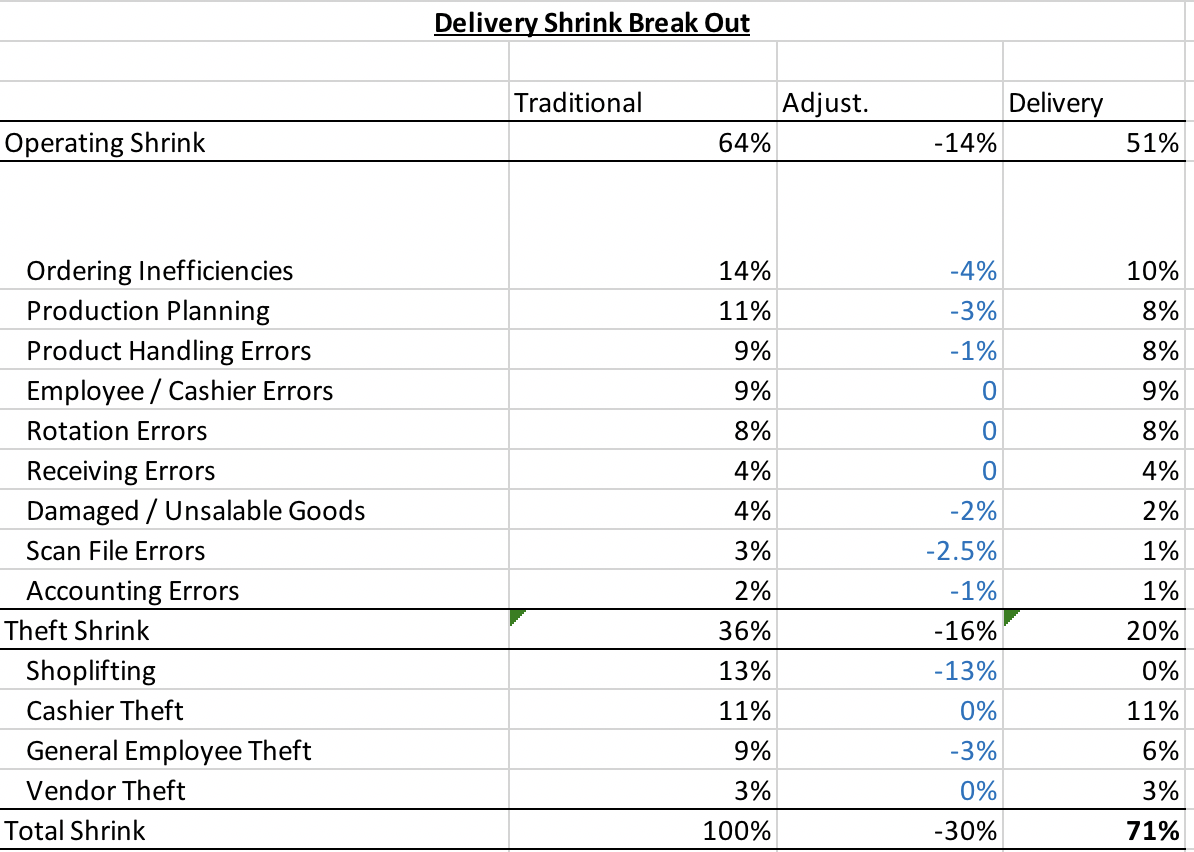

Utilizing the shrink categories detailed here, one can make some projections regarding reductions in shrink that might occur due to delivery.

One can safely assume some reduction in shrink in:

- Ordering Inefficiencies

- Production Planning

- Product Handling Errors

- Damaged/ Unsalable Goods (This is the category that delivery might most be able to improve via choice by the retailer.)

- Scan/File Errors

- Accounting Errors

- Shoplifting (This would likely go to zero.)

- General Employee Theft (Reduction here based on better tracking of items.)

Some small reductions based on delivery could potentially reduce shrink by 30%!

Model Sensitivity Analysis

Assuming all other cost components stay the same, and isolating for shrink change, this can result in material improvements if there is a shift to delivery.

Again note that this does not include additional delivery and labor costs, we are only focusing on shrink improvement.

A 8% increase to operating profit is not zero, especially in a low margin industry.

Additional Non-Obvious Benefits of Online Delivery for Grocery Retailers

- Stock Outs Now Equal Substitutions

- A good substitution engine could mean substantial improvements in overall average order size along with consumer satisfaction.

- While a consumer might not always be happy with the substitution, a well designed substitution algorithm could ultimately recommend acceptable substitutes at a higher rate than a consumer would individually substitute in-store of their own volition.

- A former stock out / sale loss can now still result in a sale. Combining this with substitutions based on higher margin items / house brands or goods that are going to spoil could result in a material margin increase and higher average order value.

- Spoilage / Shrink Can Now Be Externalized on the Consumer

- If the consumer is in charge of picking a good that is about to spoil or one that is fresher, they will almost always choose the fresher good.

- Online delivery removes that choice and while satisfaction rates need to be monitored, just because a consumer wouldn’t have chosen that item in store does not necessarily equate to lower ultimate satisfaction if they receive the good via delivery.

- Dynamic Pricing

- Grocery delivery pricing in store is relatively static compared to what can occur digitally - online prices can shift instantaneously to reflect supply and demand.

- While consumers may balk at supply/demand based pricing for grocery goods initially (Ala Uber Surge Pricing), this is an area to explore as long as trust can be maintained with consumers and that they do not feel as though they are getting fleeced ordering online.

- Shoplifting

- Difficult to shoplift when all goods are delivered.

- Low Ringing

- Low Ringing is the concept of consumers ringing up a lower priced equivalent at a self-checkout line instead of the true item (Organic Avocado vs Normal Avocado).

- Low ringing is largely eliminated online (Largely as cashiers could still technically do it, purposefully or by accident).