Active Cap Table Management

- Topics Addressed

- Cap table components are often passively managed in the sense that founders focus on the headlines - valuation and ownership.

- This post will cover how to actively manage a company’s valuation, option pool, prospective investor return, capital needs, dilution and exit multiples.

- Out of Scope

- This post does not cover the basic definitions of cap tables, including but not limited to, different types of instruments (SAFEs vs Convertible Notes vs Priced Rounds vs Options), Pre/Post Money Valuations, stages/mechanics of a priced round, or investor deck creation.

- Cap Table Basics are covered here!

- Hypotheses & Questions

- Valuation - How can entrepreneurs safely manage their valuation as it relates to both capital needs and investor returns? Are valuation and value the same thing?

- Option Pool - What are the objectives of an option pool?

- Prospective Investor Returns - Why and how should founders think about investor returns?

- Cost of Capital - How is the cost of capital derived? How can the cost of capital be reduced?

- Dilution - What are the derivative effects of dilution from a financing round?

- Exit Multiples - What is the difference between a strategic and financial acquisition? Why is this relevant?

- Assumptions

- This post is written in relation to technology based businesses, despite the discussion’s applicability to other industries.

- Conclusions & Summary

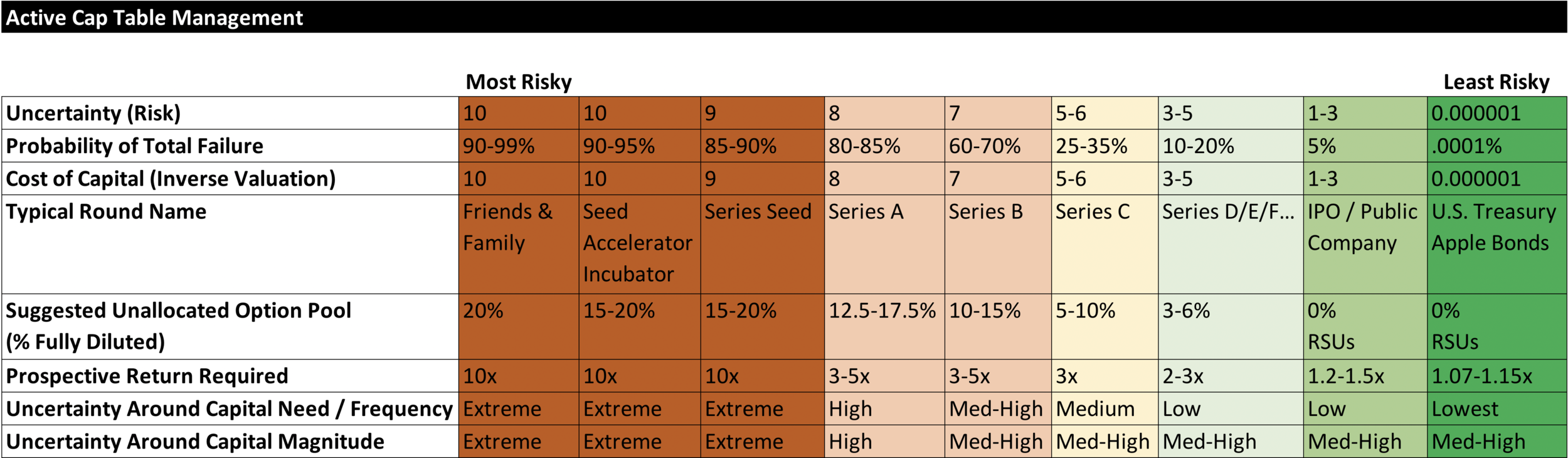

- Founders should view each of the following topics along the axis of risk:

- Higher risk / earlier stage companies being associated with lower valuations, higher option pool / investor return requirements, higher cost of capital, and higher prospects of future dilution.

- Lower risk / later stage companies being associated with higher valuations, lower option pool / investor return requirements, lower cost of capital, and lower prospects of future dilution.

- Valuation

- Valuation does not equal value.

- Valuation is both a belief, focused on the future, and a mechanic, to invest in companies.

- Value is both a belief, focused on the present, and a mechanic, to acquire companies.

- Aim for the right valuation, not the highest valuation.

- The right valuation focuses on balancing the future value of the company, dilution to existing shareholders, and the return requirements of founders and investors.

- At their most reductive, valuations are inversely related to the degree of risk and uncertainty in a business.

- High risk equates to low valuations, low risk equates to high valuations.

- Entrepreneurs should aim to reduce risk accordingly.

- Valuation does not equal value.

- Founders should view each of the following topics along the axis of risk:

- Option Pool

- Option pools exist not only to provide economic incentives to employees, but also to provide economic incentives to non-employee entities (channel partners/resellers/consultants), insurance against founder or key employee defections and to provide investors with an additional mechanic to reduce valuations.

- Option pools, similar to valuations, should be sized based on the remaining hires that will need option packages + non-employee packages + 3-6% buffer.

- Investors that request a larger option pool are essentially stating that they believe you haven’t taken the above questions into account, and are assuming you’ll have to adjust the option pool upward at some point. This is equivalent to asking for a reduced valuation.

- Prospective Investor Returns

- Prospective investor returns are highly relevant to founders in that they dictate the maximum valuation a business can have at a specific stage, with its corresponding risk / reward profile.

- When an investor balks at a specific valuation, they are not necessarily balking at the number itself, but at the probability that they will achieve a return target given the valuation.

- This can be addressed by better understanding the investor’s return requirements and reducing any uncertainty they may have in their calculation.

- Cost of Capital

- As both the degree of uncertainty and the magnitude around capital requirements increase for a business, the cost of capital increases in a related manner, ultimately equating to a decrease in valuation.

- Entrepreneurs should seek to increase certainty around both frequency and magnitude of capital needs as it will reduce both the perceived and actual future financing needs of the business. This in turn will reduce future dilution expectations and allow for higher current valuations.

- Dilution

- Dilution is often seen as simply a reduction in an entity’s ownership stake as a result of a business receiving additional financing.

- Dilution should be seen as a literal cost to shareholders, with the expense being borne at the time of acquisition and at a multiple of the original funding amount.

- Keeping valuations at reasonable levels alongside continued emphasis of capital efficiency will reduce dilution over time.

- Exit Multiples

- There are two types of exit multiples: Strategic and Financial.

- Strategic acquisitions value a business based on the future value of that business’ products being sold and/or integrated across the acquirer’s customer base.

- Strategic acquisitions are equivalent to value based pricing and are highly preferred by founders/investors.

- Financial acquisitions value a business based on a market-based multiple of sales or EBITDA.

- Financial acquisitions are equivalent to market based / competitive pricing and are highly preferred by buyers and acquirers.

- Assets & Diagrams

- The following Excel table is a relation of each of the components discussed in this post to risk.

Detailed Discussion & Examples

- Valuation

- Valuation is both a belief, focused on the future, and a mechanic, to invest in companies.

- It is a point in time belief regarding the future value of the company’s stock by specific entities.

- It is a mechanic in that it allows each party to buy or sell ownership in a given entity.

- Value is also both a belief, focused on the present, and a mechanic, to acquire companies.

- It is a point in time belief regarding the present value of the company’s stock by specific entities.

- Valuation is both a belief, focused on the future, and a mechanic, to invest in companies.

- It is a mechanic in that it allows each party to buy or sell ownership in a given entity.

- Valuation does not equal value.

- The most common trap encountered by both investors and entrepreneurs is equating valuation with value, when each focus on entirely different time periods.

- Valuation can vary enormously from investor to investor based on a multitude of factors include their return requirements, “hotness” of a given sector, belief regard exit opportunities, etc.

- Value is typically more constrained in that it is the amount the company could sell for today in its current state. In a sense, value is the “mark to market” equivalent in early stage companies.

- Recommendations Regarding Valuations

- Aim for the “Right” Valuation, Not the Highest One

- What does it mean to have the “right” valuation? How does one “get it right”?

- Aim for the “Right” Valuation, Not the Highest One

- The “right” valuation is highly company, stage, sector, investor, and potential acquirer specific.

- The “right” valuation is one that:

- Future Value - Recognizes the potential future value of the company and appropriately shares the capture of that value.

- Risk & Cost of Capital - Recognizes the uncertainty remaining in the business and prices access to capital accordingly.

- Reward & Return - Allows entrepreneurs and investors to obtain their desired reward or return.

- Future Capital Requirements - Accounts for future capital needs by providing room for the valuation to increase in the future.

- At its most basic, valuation is inversely related to cost of capital and uncertainty

- Obtaining the highest valuation possible often trades reduced dilution in the short term for unmet expectations and reduced investor returns over the long term.

- What does it mean when a prospective investor says the valuation is too high?

- Most likely, they are looking for a polite way to decline the deal for a multitude of other reasons unrelated to valuation.

- However, if a high valuation is the legitimate reason an investor does not want to invest, the investor is actually stating one or more of the following:

- I do not believe that the current valuation appropriately shares the future risk of the business between founder and investor.

- I do not believe that the value at a future point in time will allow me to hit my return targets.

- I believe that the uncertainty potentially present in the business in the future warrants a higher cost of capital (a lower valuation).

- Note that almost all of the reasons mentioned above are related to beliefs about the future.

- Option Pool

- Why do option pools exist? Survey says, answers cumulative:

- 99% of respondents answer with the following:

- To provide economic incentives to company employees.

- 10% of respondents answer with the following:

- To give investors an additional opportunity and mechanic to lower the effective valuation.

- Fred Wilson coined the term “the option pool shuffle” that best describes this phenomenon. (Link)

- To give investors an additional opportunity and mechanic to lower the effective valuation.

- 1% of respondents answer with the following:

- To provide economic incentive to entities other than employees and investors, such as channel partners or resellers.

- To provide insurance against founder or key employee defections in that there is flexible equity to incentivize replacements.

- 99% of respondents answer with the following:

- How big should the option pool be? Survey says, answers cumulative:

- 99% of respondents answer with the following:

- Between 5-15% depending on the size of the company and the stage.

- 10% of respondents answer with the following:

- Between 0-20% depending on the size of the company and the stage.

- 1% of respondents answer with the following:

- The size of the option pool should be the sum of:

- The remaining key hires multiplied by a typical option grant for that role.

- Currently planned and estimated non-employee channel partners, resellers, or consultants required.

- 3-6% buffer for future non-key employee hires (and to make investors happy even if it is never utilized)

- The size of the option pool should be the sum of:

- 99% of respondents answer with the following:

- Recommendations Regarding Option Pools

- Aim for the Goldilocks Option Pool - Not Too Big, Not Too Small

- Not so large that it adds unnecessarily dilution and gives investors the impression that the founders have not thought comprehensively about future needs.

- Not so small that it doesn’t give room to grant to key employees or that investors believe that they will have to suffer future dilution when the option pool needs to be enlarged.

- What does it mean when a prospective investor says the option pool is too small?

- Just like valuation, the investor is expressing the following beliefs about the future:

- The company will need more key hire or employee option grants than is currently planned for, resulting in dilution to the investor and company, and potentially resulting in the investor missing their return targets.

- This is ultimately stating that valuation is too high, because a lower valuation with that same pool would effectively provide the same outcome, which is greater ownership and a greater chance of hitting the investor’s return targets.

- The company has not thought comprehensively about non-employee entities it might need to incentivize.

- The company will need more key hire or employee option grants than is currently planned for, resulting in dilution to the investor and company, and potentially resulting in the investor missing their return targets.

- If you receive this comment, it is entirely reasonable to ask the investor why they believe the option pool to be too small and provide a rationale as to why you disagree.

- Just like valuation, the investor is expressing the following beliefs about the future:

- Aim for the Goldilocks Option Pool - Not Too Big, Not Too Small

- Prospective Investor Returns

- As we defined in the previous section on Valuations, valuation is a bundled, codified set of investor beliefs regarding the future value of your company.

- At an early stage (Pre-Seed/Seed/A), entrepreneurs core misunderstanding is failing to understand an investor’s required return as it relates to the other topics discussed in this post.

- In general, lower investor returns, specifically as they relate to valuation, capital requirements and exit multiples, are driven by:

- Valuations are set inappropriately high at an early stage, resulting in financings that are disproportionately dilutive to early stage investors.

- Higher than expected capital requirements, also known as poor capital efficiency, requiring additional financing and dilution.

- Exit multiples that value the business on actual/current sales or EBITDA (financial acquisitions).

- In general, higher investor returns, specifically as they relate to valuation, capital requirements and exit multiples, are driven by:

- Valuations that are set appropriately for the stage and risk of the company.

- A corollary to this is that investor returns have never been too low because the valuation was too low. However, investor returns can be low even with a low valuation.

- Low valuations do not guarantee high investor returns.

- Capital efficient businesses that exceed or at least maintain the capital requirements discussed at the time of financing.

- Exit multiples that value the business on how the business’ products can be applied strategically across the acquirer’s entire book of business (strategic acquisitions).

- Valuations that are set appropriately for the stage and risk of the company.

- As an entrepreneur why do I care about the investor’s return target? If they make money, isn’t that enough?

- Investor returns are not an abstract quantity that have no effect on the outcome you receive as an entrepreneur.

- If you do not understand your investor’s return profile, one of the following will occur:

- Under Value Your Company - If you believe that your investor’s return requirements are higher than they actually are, you may end up with a valuation that is lower than necessary, resulting in additional dilution for you and an exit valuation that is higher than was necessary to hit return targets.

- Over Value Your Company - If you believe that your investor’s return requirements are lower than they actually are, you may end up with a valuation that is higher than ideal, resulting in investors that balk, not at the business itself, but at the valuation.

- In many cases, if the investor can’t understand a path to their return targets, they simply will not invest.

- Note that this is not a path to any return, but their required return.

- Each investor will have different return requirements and targets.

- Entrepreneurs should seek to understand those requirements, prepare materials that state the business case as it relates to those targets, and be prepared to investigate alternate investors if the business’ prospects do not match the investors requirements.

- Cost of Capital

- General Rule

- As both the degree of uncertainty and the magnitude around capital requirements increase for a business, the cost of capital increases in a related manner.

- Rule Discussion

- As the cost of capital increases for early stage companies, valuations decline.

- Therefore, providing higher certainty and lower capital requirements will result in a higher valuation and/or lower dilution for the same business.

- Uncertainty can often have a greater impact on the cost of capital than the amount required.

- As an entrepreneur, how can I increase certainty around capital requirements and their magnitude?

- Most entrepreneurs provide Sources & Uses slides with very little commentary regarding the why behind their selections and what the outcome will be from using this capital. Note the difference in the example below:

- $100,000 will be used on Google Search Ads

- $100,000 will be used on Google Search Ads to acquire 1,000 customers ($100 CAC) that have a lifetime value of $400 ($400 LTV), with an LTV/CAC of 4x.

- The former simply discussed the use, the later discussed the outcome.

- Reducing the Degree of Uncertainty Around Capital Need

- As an investor, I care about both the one time and recurring capital needs of the business, because if either exceed the self-financing ability of the business, additional financing events will occur, resulting in dilution and return reduction.

- The degree of uncertainty around capital need can be reduced by describing:

- The initial cause for the capital requirement.

- The subsequent or recurring causes for that capital requirement, if relevant.

- The manner in which those capital needs will be financed.

- If as an entrepreneur you can systematically provide detail around the causes as well as ability to self-finance those causes, it will dramatically reduce investor uncertainty, and eliminate another reason to reduce your valuation.

- Reducing Uncertainty Around Capital Magnitude

- As an investor, I also care about the magnitude of one time and recurring capital needs of the business.

- If they are low, there is a higher chance that they can be self-financed.

- If they are high, there is a higher chance that they will need additional financing rounds to satisfy.

- If as an entrepreneur you can provide a rationale around the size of future capital needs, it will dramatically reduce investor uncertainty, and eliminate another reason to reduce your valuation.

- In some cases, this can even be helpful to investors as they plan follow on financings that will allow them to exceed their return targets.

- As an investor, I also care about the magnitude of one time and recurring capital needs of the business.

- Most entrepreneurs provide Sources & Uses slides with very little commentary regarding the why behind their selections and what the outcome will be from using this capital. Note the difference in the example below:

- General Rule

- Dilution

- Dilution is often seen as simply a reduction in an entity’s ownership stake as a result of a business receiving additional financing.

- However, there are several non-intuitive downstream effects of dilution, many of which can cause additional subsequent dilution :

- Increases the required exit value to achieve founder and existing investor return targets.

- A higher required exit value also increases the time it will typically take to achieve the required exit value which also increases the risk the required exit value will not be achieved due to the shelf life of technology.

- Reduced employee option pool incentive effectiveness.

- As dilution occurs, past/present/future employee option grants decline in value, resulting in additional dilution if true up grants are required to retain employees.

- Increases the required exit value to achieve founder and existing investor return targets.

- As an entrepreneur, how can I reduce dilution and the potential derivative effects?

- Keep valuations reasonable at each stage to avoid down rounds in which anti-dilution provisions activate.

- Size the optional pool optimally at each round such that the needs of the business and investor uncertainty are aligned.

- Ensure capital efficiency is a key value among founders and employees.

- Every dollar that is spent unnecessarily is another dollar of dilution that founders and employees will experience when the next round of financing is required or upon acquisition.

- Exit Types & Multiples

- Two Exit Types

- Strategic - A multiple of sales or EBITDA that values the company based on a strategic objective of the acquirer.

- Financial - A multiple of sales or EBITDA that values the company based the actual sales or EBITDA of the business.

- Strategic Acquisition - What Entrepreneurs And Investors Both Want

- Strategic acquisitions are a misnomer in that the multiple has almost no bearing on the acquisition price and is instead an outcome of the strategic nature of the acquisition.

- Strategic acquisitions are equivalent to value based pricing of a business to an acquirer.

- For example, when a tech giant purchases a startup in a strategic acquisition for 100x sales, what does that mean?

- Say the startup’s annual sales were $500,000, and the acquisition price was 100x sales, or $50,000,000.

- The acquirer is not paying $50,000,000 for the startup’s current revenue or customer base.

- They are paying that amount, and the resulting multiple, because they believe the value they will obtain over time selling the acquired product across the entire customer base is greater than $50,000,000.

- In almost every case aside from an IPO, a strategic acquisition should be the objective of every entrepreneur and investor because it allows the realization of future value of the company across a much wider swath of customers than the startup might ever realize on its own, in a much shorter time frame.

- Financial Acquisition - What Buyers & Acquirers Want

- Financial acquisitions are directly related to the sales or EBITDA of the business, with the acquisition price based on market multiples at the time.

- Financial acquisitions can be thought of as competition / market-based pricing in that they are independent of future value creation at the acquirer.

- As an example, if the same startup discussed above with $500,000 in sales is acquired for a 10x sales multiple, the business would achieve a $5,000,000 exit.

- If this startup had taken funding, this amount would likely provide investors with some return, but not enough to hit their preferred return targets.

- In addition, this amount would likely provide the founders with a small amount, but likely less than if they had simply worked at a large tech company in the first place.

- Acquirers and buyers of companies typically like to purchase businesses using sales/EBITDA multiples because it allows them to realize the benefits of strategic integration over time.

- Entrepreneurs and investors can avoid this trap by ensuring that they have understood precisely what their potential acquirers desire in an acquisition and how it can be packaged for optimal integration.

- Two Exit Types

Further Reading, References & Data

- Disclaimer - I claim no ownership of any of the content below, PDFs are provided only for reference in case they disappear from the original link.

- Venture Capital Risk and Return Matrix - Industry Ventures - (Link)

- Great look at typical return profiles by stage.

- Acquisition Types - McKinsey - (Link)

- Pricing - From ProfitWell