Derivative Economic Theory

Summary

Topics Addressed

- This post first provides a definition of a new economic theory, Derivative Economic Theory (DET), which posits that companies are beginning to shift from monetizing the goods and services they provide to monetizing derivatives of those goods or services.

- It also provides 10 individual examples illustrating companies that have utilized DET.

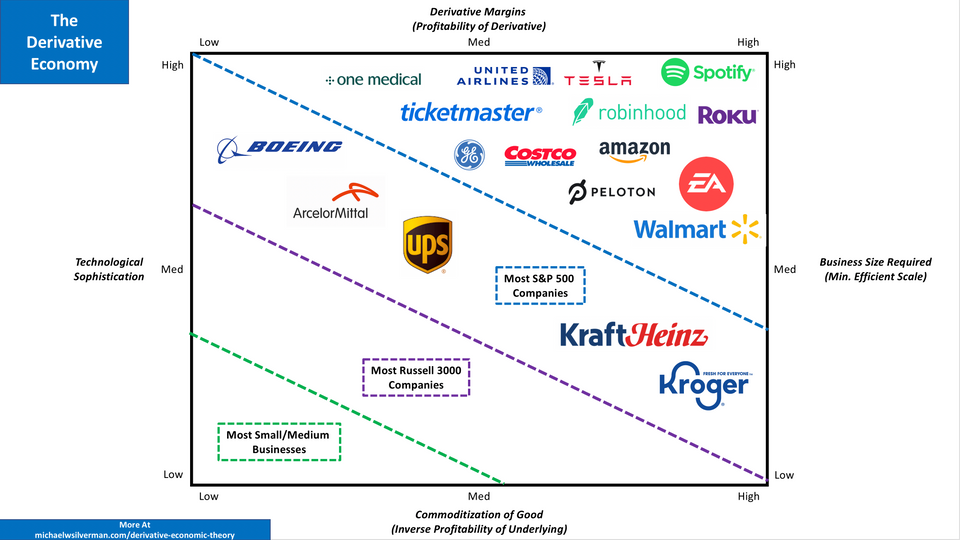

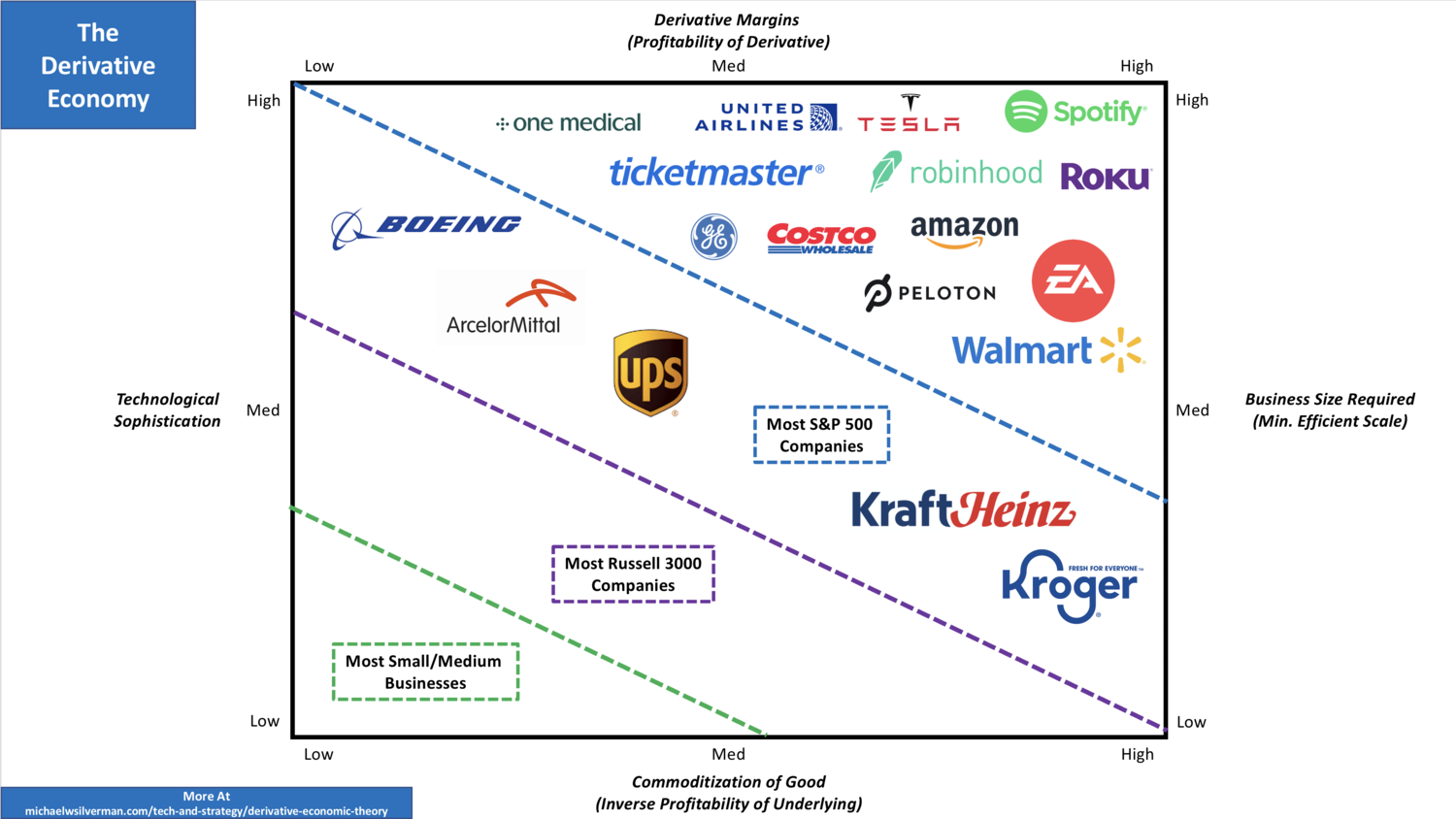

- In addition, a graphic plotting companies across 4 different axes that relate to DET is also provided.

Out of Scope

- Detailed discussion regarding how companies not yet taking advantage of DET might alter their business models in order to monetize derivatives versus underlying products or services.

- Detailed discussion regarding any limits on derivative creation or profitability ceilings.

Hypotheses & Questions

- Due to increasing commoditization of goods and services alongside technological sophistication, it is no longer profitable enough for firms to simply monetize the goods and services under their purview. They must create new markets based on the products and services that they sell.

- Companies that operate according to DET will outperform those that do not, as they will be able to continuously expand both the number of derivatives outstanding based on their products in a non-linear fashion and the profitability of those derivatives.

Background Knowledge Required

- Basic Understanding of Financial Reports & Terms including Revenue, Gross Margin, Gross Profit (Wikipedia)

- Basic understanding of economics, economic theory, and economic concepts (Wikipedia)

- Minimum Efficient Scale (MES) (Wikipedia)

- Derivatives (Wikipedia) - Conceptually rather than specifically for financial derivatives.

Conclusions

- Companies that are able to operate under DET will ultimately have higher profitability, continue to grow, and maintain stronger product differentiation over time.

- In markets which are commoditized, technologically sophisticated, and require a MES, companies will need to begin to monetize derivatives in order to achieve internal and external return expectations.

Detailed Discussion - Derivative Economic Theory (DET)

To start, derivative’s definition when used as a noun, is as follows:

- A form of something, such as a word, made or developed from another form.

- A financial product such as an option that has a value based on the value of another product, such as shares or bond.

This post proposes a new economic theory, Derivative Economic Theory (DET), which states that:

In sectors or industries in which technology has commoditized what were once value added components, the most efficient remaining method of obtaining profits is via the sale or monetization of derivatives of the underlying product or service being sold.

DET is a recent phenomenon due to the confluence of 3 separate factors, all of which are pre-requisites for a company or industry to transition to operating under DET:

Commoditization of the Underlying

- The underlying goods or services must be commoditized to the degree that the underlying good or service can no longer be sold for the rate of return demanded by either internal business managers or external shareholders.

- This forces the company or industry to begin the process of derivative creation and monetization.

Increasing Technology Sophistication

- New or existing entrants have become increasingly technologically sophisticated, capturing significant amounts of data, allowing the creation and monetization of low/no cost derivative products/services.

- In order of the derivatives to have and retain value, data collected must be significant enough in both magnitude as well as edge case coverage to ensure proper pricing.

Achievement of Minimum Efficient Scale

- New or existing entrants have achieved the minimum efficient scale (MES) required to create a sustainable derivatives market.

- In order for the derivatives to have and retain value, consumers or buyers of those derivatives must perceive the company as enduring relative to the lifetime of the derivative.

While each of these factors are requirements in order to operate according to DET, the possession of one or more factors does not necessarily mean a company can operate according to DET.

In addition, a key point of DET is a focus on profit generation, not necessarily revenue generation. Revenues are still generated by sales of the underlying goods and allow each company to operate at the minimum efficient scale required in order to sell the profit generating derivatives.

A company may operate in a highly commoditized market with significant scale, but may not possess the internal technological sophistication required.

- Most S&P 500 companies that have not yet switched to a derivative monetization model.

A company may operate in a highly commoditized market with sophisticated technology, but may not operate at the scale required.

- Most Russell 3000 companies that have not yet reached MES.

A company may operate at significant scale with sophisticated technology, but the underlying good may not be commoditized to the degree that would force the company to monetize derivates (the underlying good or service remains profitable enough).

- A rarer phenomenon, but often seen in monopoly-like businesses such as Boeing.

A company may not possess technological sophistication or MES, but sells a proprietary or differentiated product.

- Most small to medium sized businesses fall in this category.

A visual summary of these factors along with sample companies is provided below, preceded by a brief discussion of the consequences of DET.

Consequences of DET

Reduced Competition Due to MES Requirements

- As certain sectors and businesses shift towards the monetization of derivatives over monetization of the underlying, it should become more difficult for new entrants in markets where minimum efficient scale is proportionately more important for the success of derivative monetization.

- For example, in video game sales, the vast majority of profits have shifted from game sales to downloadable content sales, but this shift can be monetized by both small and large players alike. MES plays less of a role in this category.

- However, in the Big Box Category, it would be very difficult for a new entrant to monetize memberships as effectively as Costco or Amazon, as consumers amortize the cost of the membership over the entire package of services provided.

Quality Reduction Due to Focus on Derivatives over Products

- The quality of products and services may decline as companies shift from monetizing products to monetizing derivatives.

- For example, if an airline such as United makes the vast majority of its profits from selling airline miles to credit card companies (see example below) it is drastically less incentivized to care about the quality of the underlying product and experience (flights).

- The company will care only to the extent that it must in order to continue to sell air miles, which is likely a level below what the market would normally demand or expect if monetization was solely based on the underlying.

Visual Summary of DET

Examples

Airlines - Mile Sales & Fuel Speculation

Prior to COVID-19, airlines have been steady sellers of airline miles to big banks, which in turn provide them to consumers as rewards for their credit card spend. While airline milage program profitability is relatively opaque, data indicates that milage programs can often provide 20% of an airline’s revenue and more than 50% of its profit. [1]

Browser Defaults - Firefox & Safari Sale of Search

Firefox: Firefox’s most recent foundation report, they received at least 50% of their revenue from “Royalties” paid by Google in order to ensure that Google remains the default search engine.[2]

Safari: Based on a 2018 report from Business Insider’s, Apple’s per year revenue for placing Google in the default position in Safari is approximately $9-$12 billion.[3]

Free Brokers & Order Flow - Robinhood / WeBull

As most brokers have transitioned to commission-free stock trades, payments in exchange for retail order flow have increased in importance, particularly for Robinhood and WeBull that do not have the traditional asset base of a broker such as Fidelity or Schwab to leverage in order to achieve profitability. While it is unclear what percent of Robinhood’s revenue originates from order flow payments, Robinhood’s payments are nearly double the industry average, and adjusted for Robinhood’s market share, even more significant.[4]

Tesla - Clean Car Credits

The vast majority of Tesla’s profits as a company have been due to the sale of emission credits to existing vehicle manufacturer’s that have not yet introduced enough clean vehicles to avoid purchasing emission credits. Despite selling hundreds of thousands of cars per year, Tesla’s profitability hinges on the payment of credits by other car manufacturers, not the cars themselves.As an example, in 2020 Q2, Tesla’s emission credit sales contributed ~$400 million in pre-tax profits, without which Tesla’s net income would be negative.[5]

Costco - Memberships are King

For the Fiscal Year ending August 30, 2020, Costco had Net Sales of $163B with Membership Fees of $3.5B, with a Sales Gross margin of 11% and an SG&A margin as a percent of sales of 10%, and Operating Income of $4B. Quick math will illustrate that the vast majority of Net Income stems from Membership Sales, and not the sale of underlying goods.[6]

LiveNation & Ticketmaster - Fees on Tickets

The entire business model is derivative in that LiveNation’s revenue and profits are derived from the fees paid when tickets are purchased as well as advertising fees paid by concerts for promotion. Livenation, for the most part, does not actually provide a product or service aside from facilitating the advertisement and sale of tickets.[7]

Amazon - Memberships and Advertising

While Amazon could merit an entire post on its own, two aspects that stand out are membership fee’s similar to Costco as well as the fees it now makes by charging others to advertise on Amazon. Walmart has begun to follow the same model with Walmart+. Amazon’s profits will be increasingly reliant on derivatives of its massive logistics network and consumer mindshare, over selling actual goods.[8]

Electronic Arts & Video Games - DLC & Content are King

Electronic Arts is one of the largest video game creators in the world, but not derives the vast majority of its revenue not from games, but from downloadable content related to the games. For Fiscal Year 2020, Ending March 31st, just over 50% of EA’s total revenue was derived from “sales of extra content for console, PC, browser games, game software licensed to our third-party publishing partners who distribute our games digitally, subscriptions, and advertising”[9]

Peloton - Bikes versus Classes

Peloton’s revenue mix will continue to shift over time from the sale of “Connected Fitness Products” to “Subscription” revenue as more hardware is sold and the digital flywheel begins to accelerate. At some point, it will likely make more sense for Peloton to monetize the hardware through additional services, than to sell additional hardware.

Profitability of subscription derivatives is already clear though, as evidenced in the Fiscal 2020 10k ending on June 30, 2020 vs 2019:

Connected Fitness Products (In Millions)

- 2019: Revenue (733), Gross Margin % (42%)

- 2020: Revenue (1,462), Gross Margin % (43%)

Subscription:

- 2019: Revenue (181), Gross Margin % (43%)

- 2020: Revenue (363), Gross Margin % (57%) [10]

Roku - Ads vs Devices

Roku, a popular manufacturer of streaming sticks and developer of the Roku Operating System that is sold to TV manufactures, makes the vast majority of its revenue, as well as profits, not from the underlying sticks and software, but from the advertisements that run across each device.

From Roku’s 10K Ending Fiscal Year December 2019

Definitions

- Platform - Software on Installed Devices, Advertising

- Player - Physical devices sold at electronic retailers.

Net Revenue (66% Platform, 34% Player)

Cost of Revenue (23% Platform, 33% Player)

Gross Profit (43% Platform, 1% Player)[11]

Additional Miscellaneous Examples:

- 2008 Financial Crisis - It could be argued that the 2008 Financial Crisis was a crisis of DET due to the entire incentive chain’s construction predicated on origination, servicing and rating fees associated with mortgages, and not revenue from the underlying mortgages themselves.

- Patent Trolls - The business is profitable not due to any underlying exchange of good or service, but due to the derivative lawsuits that accompany the patents.

- Uber/Lyft - At some point, these businesses will discover that the core business is unprofitable as it currently stands and will monetize using derivatives, some of which could include car insurance, driving data sales to autonomous vehicle firms, and advertisements for local services.

- OneMedical - Primarily monetizing membership fees over actual medical services rendered.

- GE - Monetization of service contracts and insurance/financing schemes over actual sale of jet engines and wind turbines.

- Spotify - Monetization of ad sales that are played during podcasts and for non-premium users over monetization via subscription revenue.