Cap Table Basics - Math, Terms, Definitions, Examples

Topics Addressed

This post will explore the basics of capitalization tables for companies, starting with definitions of terminology and ending with a comprehensive example of a company raising capital.

Out of Scope

This post does not discuss the legal structures surrounding capital financings known as term sheets, which will be discussed separately. However, it does discuss several terms from term sheets which are cap table related, primarily participation and preference.

It does not discuss more advanced strategies around cap table management, some of which have been discussed in this post: Active Cap Table Management.

It does not discuss cap table waterfall analysis or convertible note mechanics in detail.

Assumptions

This post assumes some basic knowledge of business terminology alongside comfort with manipulating algebraic formulas.

Excel Models & Assets

The full excel model for the example in this post can be downloaded here.

Further Reading, References & Data

- Disclaimer - I claim no ownership of any of the content below, PDFs are provided only for reference in case they disappear from the original link.

- Venture Deals - Brad Feld -> A great resource for all things VC. (Amazon Link)

- Cap Table Math - Dave Lishego -> This post most closely aligned with how I approached cap table math, and is another great read. (LINK) and PDF below.

Cap Table Terms & Definitions

As an entrepreneur, you are already at a disadvantage in managing your cap table compared to investors and service providers. While you will only manage your individual cap table, investors and service providers will see thousands of different cap tables along with specific edge cases over the course of their career. However, successfully managing your cap table comes down to understanding how terminology is defined and how several key numbers are calculated. We’ll start with brief (I promise!) definitions with relevant formulas for calculating the term, followed by an example of a lemonade stand that is raising capital. Definitions are in approximate alphabetical order, rearranged if it made more sense to do so.

Anti-Dilution - Weighted Average and (Full) Ratchet Based

- Weighted Average AD

- More common that the anti-dilution provisions below because it takes into account both the price of newly issued shares as well as the magnitude of the capital raise.

- Intuitively, WAAD adjusts the Series A price proportionate to the price difference.

- The exact formula is as follows and will make more sense in the example below.

- CP2 = CP1 * (A+B) / (A+C)

- CP2 = Series A Conversion Price in effect immediately after new issue

- CP1 = Series A Conversion Price in effect immediately prior to new issue

- A = Number of shares of Common Stock deemed to be outstanding immediately prior to new issue (includes all shares of outstanding common stock, all shares of outstanding preferred stock on an as-converted basis, and all outstanding options on an as-exercised basis; and does not include any convertible securities converting into this round of financing)

- B = Aggregate consideration received by the Company with respect to the new issue divided by CP1

- C = Number of shares of stock issued in the subject transaction

- Formula courtesy of the NVCA and their template term sheet (Link).

- CP2 = CP1 * (A+B) / (A+C)

- (Full) Ratchet AD

- If the price of Series A Preferred stock is $10.00 per share, and the Series A Preferred holders have Full Ratchet AD protections/terms, and a subsequent Series B Preferred round is completed at $5.00 per share, the Series A Preferred holders will effectively pay the same price, $5.00 per share, even though they invested prior to the Series B.

- They are “fully protected” from the down round by having their purchase price for the Series A Preferred shares retroactively reduced, effectively increasing their ownership.

- (Partial) Ratchet AD

- If the price of Series A Preferred stock is $10.00 per share, and the Series A Preferred holders have Partial (1/2) Ratchet AD protections/terms, and a subsequent Series B Preferred round is completed at $5.00 per share, the Series A Preferred holders will effectively pay $7.50 per share, even though they invested prior to the Series B.

- They are “partially protected” from the down round by having their purchase price for the Series A Preferred shares retroactively reduced, effectively increasing their ownership.

Authorized Shares

- Definition - The number of authorized shares is the number of shares, across all classes, your company can issue based on its corporate bylaws and structure.

- Notes

- Always want to make sure that the number of shares your company is authorized to issue is greater than the number actually issued.

- Generally, you want to have a significant number of shares (1M+) authorized just to make the math easier, however this can readily be changed later on.

Convertible Notes, Discounts, Caps

- Definition - Convertible notes are a method that allows investors in early stage companies to invest capital while avoiding the negotiation of a priced round. They are a loan to the company that “converts” into equity, typically Common shares, when certain conditions are met. They typically also have a discount and a cap.

- Discount - A discount is a percentage that is subtracted from the company’s valuation at conversion. As an example, if a convertible note has a 20% discount, and a company raises a priced round at a $10m Pre-Money Valuation, the Noteholder’s effective valuation would be $10m * (1-.2) = $8m

- Cap - A cap is the maximum valuation that a note holder will convert at in the next priced round. As an example, if a convertible note has a $5m cap, and a company raises a priced round at a $10m Pre-Money Valuation, the Noteholder’s effective valuation would be $5m.

- Notes

- Note that Caps and Discounts are often AND/OR in the sense that the Noteholder can select which they prefer (OR) or utilize both (AND).

- Conversion can also be at the same time as the priced round investors or before the equity investors. This post and example assumes it is before, which is, I believe, to be more reflective of reality.

- A separate post exploring the details around Convertible Notes will also be written.

Dilution

- Definition - Dilution is what occurs to existing shareholders when new investors purchase shares in your company. More specifically, dilution is the reduction in ownership by existing investors as a result of the sale of that ownership to new investors.

Issued Shares

- Definition - The number of shares, across all classes, that your company has actually issued and that belong to individuals or entities.

Option Pool

- Definition - A percent of your company’s cap table dedicated to options that can be given out to employees, contractors or others as additional economic incentive.

- Notes

- This should typically be reported in the cap table as total shares, allocated shares, unallocated shares so it is easy to understand the portion that can still be allocated to future employees.

- Option holders are typically reported in a separate table or rolled up for reporting purposes. Cap tables generally report the option pool as a combined entity.

Option Pool “Shuffle”

- Definition - Coined by Fred Wilson, the option pool shuffle is a colloquial term for investors utilizing the option pool to effectively lower the price of the financing.

- Notes

- While it is sometimes used maliciously by VCs on unsuspecting entrepreneurs, it is meant to be a conversation around understanding the future option needs of the business and how to fairly share the dilution that will result.

- This situation typically arises when founders enter a financing negotiation with an option pool that is too small relative to what the investors desire/expect.

- VCs will typically argue that, if the business does not currently have an option pool, the entrepreneur should be the recipient of the dilution. If you press on this question and ask why the VCs and entrepreneur shouldn’t share the dilution equally or at some other ratio, there isn’t a great reason other than industry convention. If that is unsatisfying, ignore the cognitive dissonance and just focus on the price that the VC should pay for their shares, as that is the root question option pool dilution allocation is fundamentally answering.

Ownership vs Fully Diluted Ownership

- Definition - Ownership is simply the number of shares owned/total shares, while fully diluted ownership takes into account additional instruments that may not have been issued or converted yet (options, warrants, convertible notes, etc.).

- Notes

- When discussing ownership percentages, most investors are typically referring to fully diluted ownership percentages.

Participation - Full, Capped, None

- Definition - Participation is a term attached to an investment in a specific series of stock, typically a priced round, that allows an investor to continue to receive liquidation proceeds even after they have received their preference.

- Notes

- Participation is typically referred to in the context of preference.

- Full Participation - Fully participating shares will first receive their preference, then “participate” in the amounts flowing to Common shareholders on a pro-rata basis.

- Capped Participation - Shares with capped participation will first receive their preference, then “participate in the amounts flowing to Common shareholders on a pro-rata basis, until they receive a certain multiple of the original investment.

- No Participation - Shares with no participation will simply receive their preference and do not “participate” in future flows to Common shareholders.

- Preferred shareholders almost universally have the option of converting to common if the return is greater than receiving the amounts due under capped or no participation.

Preference

- Definition - Preference is a term attached to an investment in a specific series of stock, typically a priced round, that allows an investor to receive a specified amount or return ahead of, or in preference to, other shareholders when a liquidity event or sale occurs.

- Notes

- It is typically written as some variant of “Holder of Series A Preferred stock will receive [X] times the Original Purchase Price in preference to holders of Common Stock”

- If X = 2, that would mean that Series A Preferred will first get 2x their purchase price in a liquidation event, before any amount flows to Common shareholders.

- Typically, preference is set as 1x, or money back, but can be higher based on the risk inherent in the company.

Post-Money

- Definition - The value of your entity/business/company tomorrow, after investment.

- Notes

- Post-Money Valuation = Pre-Money Valuation + Investment Amount

Pre-Money Valuation

- Definition - The value of your entity/business/company today, prior to investment

Priced Round

- Definition - A round in which a specific share price and valuation have been agreed upon.

- Notes

- This is in contrast to rounds where convertible debt, SAFEs or other financial instruments are utilized specifically to avoid pricing the round. This has benefits and costs to it that will be discussed separately.

Return Waterfall

- Definition - A return waterfall, or typically just called the “waterfall” is analysis that illustrates the order and amount of capital allocated to specific shareholders at a certain liquidation price.

- Notes

- For later stage companies, this can get extremely complicated as different preference and participation terms stack on top of each other.

Rounding

- Definition - Rounding mistakes are easy to avoid as long as you apply a standard rounding policy across all rounds. This is as easy as using the Round(Amount, 0) function in Excel to round to the closest share number.

Share Classes

- Definition - A share class is a way for investors to create an ownership structure that has additional rights and protections than the default Common share class that founders and optional holders typically possess.

- Notes

- These will often have the notation as “Series A” or “Series A Participating” or “Series A Participating Preferred” depending on the round of investment and investment terms.

- Founders and option holders typically own Common Shares, which have the fewest rights to the ultimate returns of the business. Priced-round (Series A onward) investors will likely demand a different share class than Common.

Subscriber Name vs Entity

- Definition - Early stage financings will often have a mix of professional and angel investors, some of which will invest under their personal name, some of which will invest through an entity.

- Notes

- Make sure you note down both their Name as well as their Investment Entity Name and understand which they would like to be on the investment paperwork. This is often a source of mistakes in early stage financings.

Valuation

- Definition - The value of your entity/business/company.

- Notes

- VCs will typically refer to Post-Money Valuation, not Pre-Money Valuation when discussing their investment in your company.

- For more on valuation, see Active Cap Table Management.

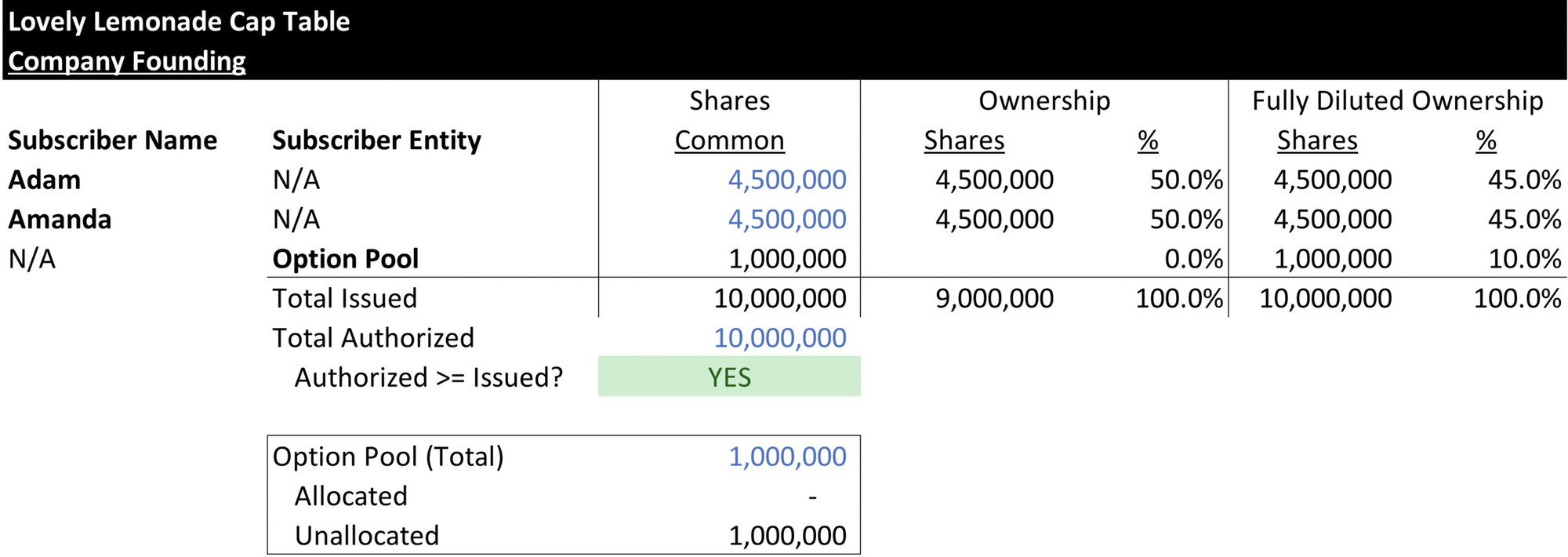

Fundraising Example - Lovely Lemonade

Congratulations Adam! You’ve decided to start a super premium lemonade stand, Lovely Lemonade, and you believe the prospects for your business are bright. You’ve also decided that your friend Amanda would be an amazing co-founder, and after many glasses of free lemonade, she agrees to be your co-founder! Given how early the business is in its lifespan, you’ve both decided to split the company’s ownership structure right down the middle. We’ll assume you have both invested a nominal amount for your Founder Common shares. In addition, you’ve authorized 10,000,000 shares to start with a 10% option pool based on your lawyer’s advice, filed all the requisite paperwork, and are in business! You’ve got your first cap table:

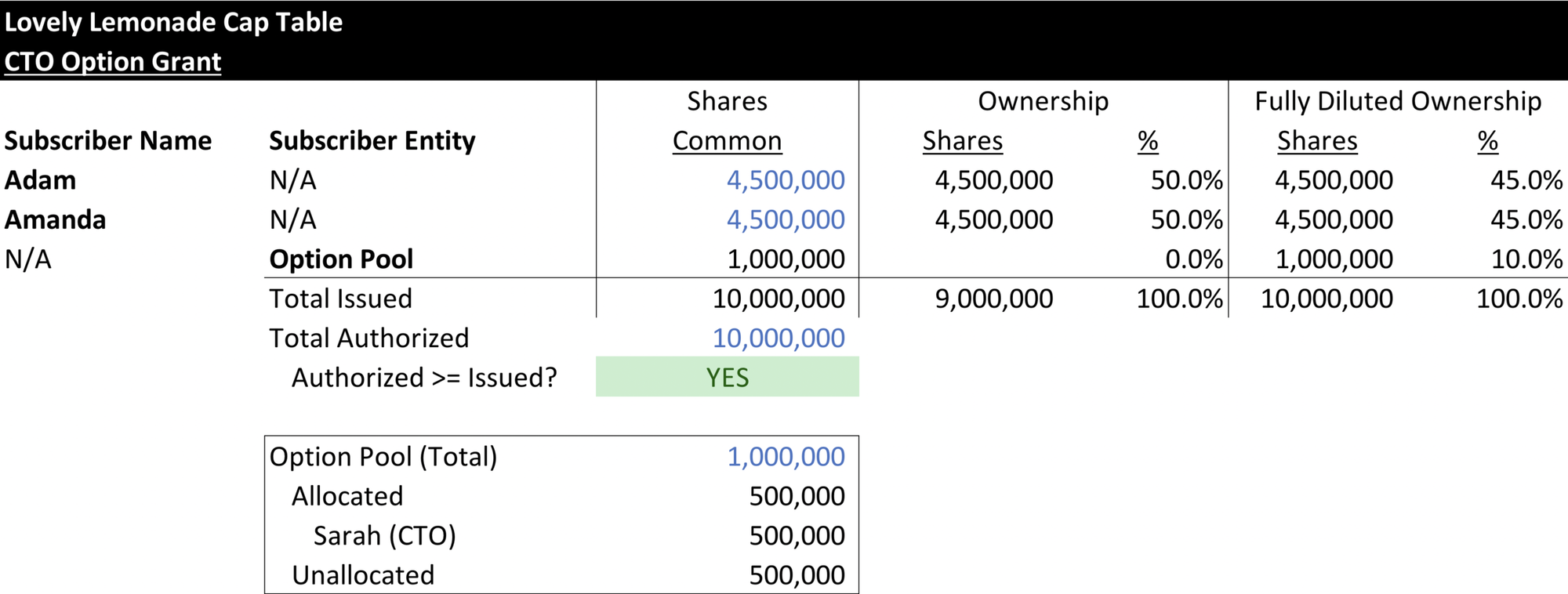

Business is going great and you need to hire a CTO to help manage all of the app-based lemonade orders that are arriving - thank the millennials! You decide that in addition to granting Sarah a decent starting salary, you want to provide a 5% fully diluted option grant to your CTO to incentivize them to stay for the long term. There goes a decent chunk of the pool, but hey, those negative margin app orders don’t prioritize themselves. You make the requisite cap table changes:

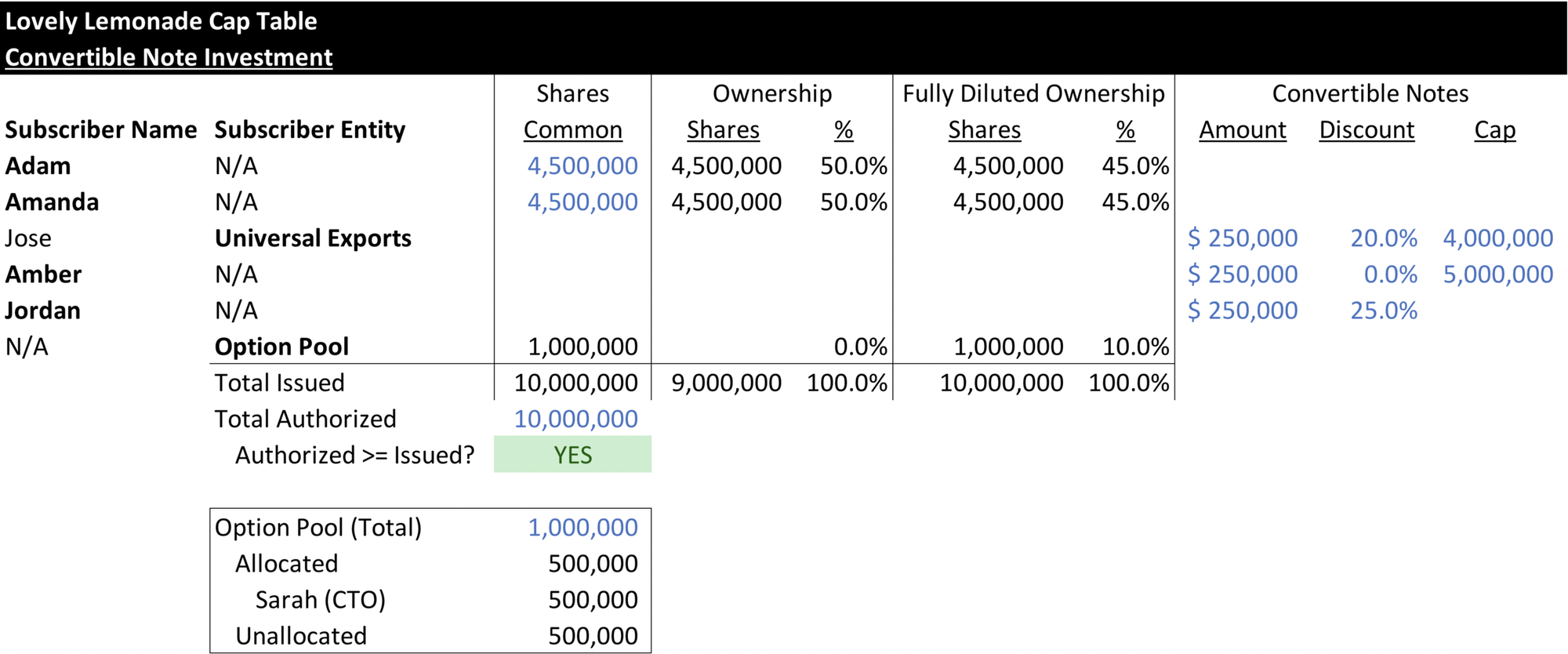

Who knew that lemonade was in such demand? While your Ludicrous Lemonade recipe has been slow to catch on (a combination of caffeine and lemonade for the nootropic crowd), the Lavender Lemonade w/essential oils has been a hit with the more cerebral crowd. Such a hit that Jose, a consumer beverage angel investor, has noticed and wants to invest! Given the company is still small and wants to avoid the costs and complexities of priced round, you and Jose mutually agree to a $250,000 convertible note, with a 20% discount and a $3m pre-money cap, invested through his entity “Universal Exports”. A month later, Jose introduces Amber and Jordan, additional angel investors interested in the company. Because of the progress that has been made, Amber decides to invest $250,000 via a convertible note, with no discount but a $5m pre-money cap, with Jordan investing $250,000 via a convertible note, with a 25% discount without a cap. Because of the Fed’s free money policies, you are able to convince your investors to take a 0% interest rate on the notes. You are starting to regret taking all this capital via convertible notes with different terms and provisions, but cash is king. Despite taking investment via convertible note, none of the investors technically own any shares in your company yet, so you track their terms and add a line item for them, but your cap table stays the same for the time being:

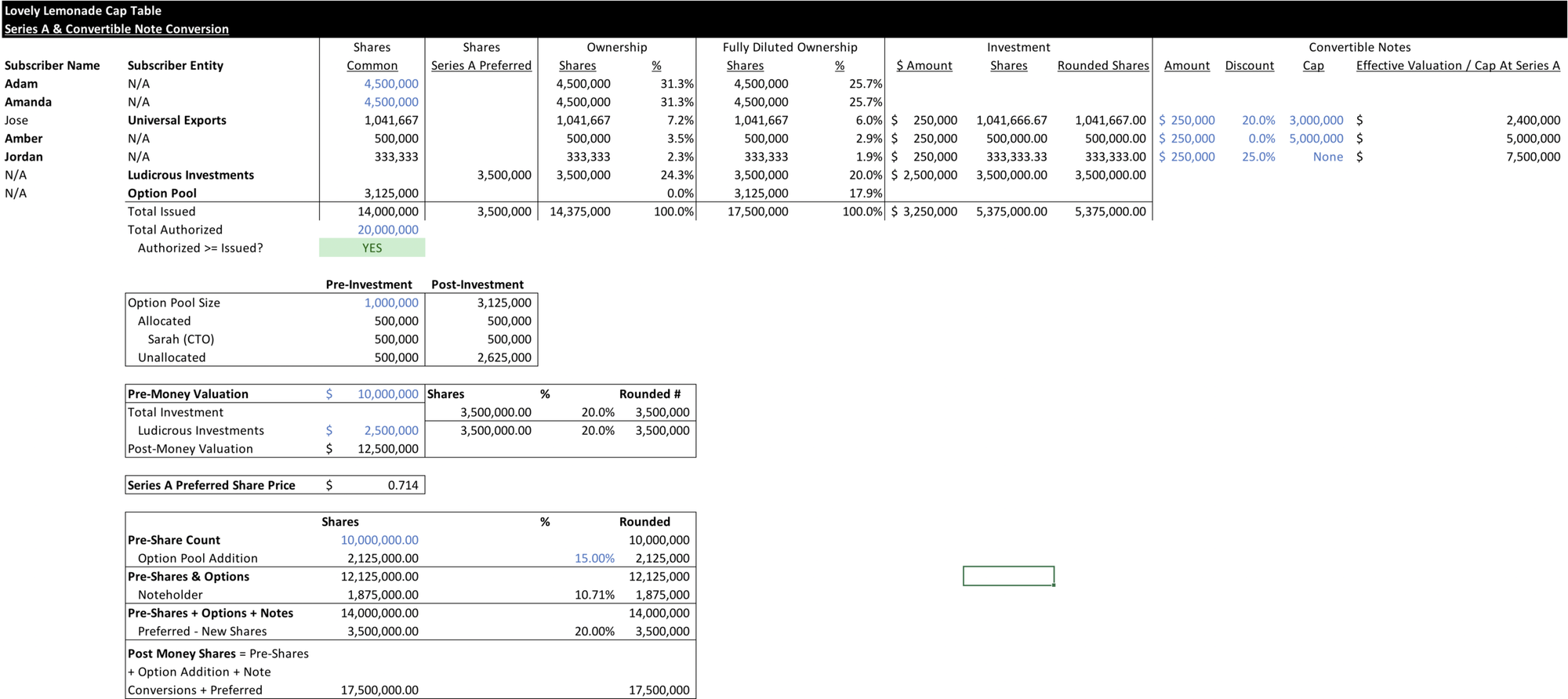

After you were able to obtain Ludicrous’ official endorsement, your Ludicrous Lemonade is now selling by the pallet each week - you need more capital to support the additional logistics and staffing demands. As luck would have it, Ludicrous Investments, a consumer packaged goods investment firm conspicuously unrelated to Ludicrous the rapper, is interested in leading a $2,500,000 Series A investment at a Valuation of $10,000,000 with an option pool of 15%. Given the risk inherent in a lemonade stand, they insist on 2x Preference with Participation with WAAD measures. At first, you think that $10m for a lemonade stand is overvalued, but then you remember that Ludicrous Investments is investing with OPM (Other People’s Money) out of their 5th fund, and that they care less about reality, and more about putting capital to work and collecting fees than actual returns. Besides, they are getting some pretty good preference, participation and anti-dilution rights.

Because you’ve done your homework, you clarify that the $10m valuation is the Pre-Money Valuation and that they desire a 15% Post-Money Option Pool, which given the current unallocated 5% FD option pool, means you are going to have to bump that up. You also need to handle the convertible note holders, some of which will be happier than others.

Even with your higher priced lawyer, you consult a fellow VC friend (who isn’t giving you money in this round, yet you still consider them a friend because they are helping you understand cap tables) to explain how all the calculations work:

- Pre-Round Information

- First, you confirm that the Pre-Money Valuation is $10,000,000 and that your Pre-Share Count is 10,000,000, with 500,000 unallocated options out of a 1,000,000 share pool.

- Series A Ownership

- Second, you calculate that the ownership of Ludicrous Investments is 20%.

- This is because investing $2.5M on a Pre-Money Valuation of $10M, means the company has a Post-Money Valuation of $12.5M.

- Series A Ownership % = Investment / Post-Money Valuation = Investment / (Pre-Money Valuation + Investment)

- $2.5M / $12.5M = 20%.

- Noteholder Conversion

- Third, you drink a tall cold glass of Ludicrous Lemonade before handling your convertible note holders.

- Jose

- Jose at Universal exports is the happiest, as he negotiated a discount and cap note.

- As the Pre-Money Valuation is $10m, his cap and discount will apply, with his note’s effective valuation being $2.4M ($3m*80%).

- Valuation Cap * (1-Discount %)

- Next, we calculate the number of shares Jose will receive.

- # Shares = (Note Principal + Interest) / (Effective Note Valuation / Pre-Money Share Count)

- Note that (Effective Note Value / Pre-Money Share Count) = Note Share Price

- # Shares = (250,000)/(2,400,000 / 10,000,000) = 1,041,667 Shares

- Amber

- Amber is fairly happy, as while she didn’t negotiate a discount, she did negotiate a cap that is 50% of the Series A Pre-Money, good on her!

- Effective Valuation = $5M

- # Shares = (250,000) / (5,000,000 / 10,000,000) = 500,000 Shares

- Jordan

- Jordan is fairly unhappy, despite you sending a pallet of Lavender Lemonade their way, because they only negotiated a discount, and not a cap.

- Effective Valuation = $10M * (1-.25) = $7.5M

- # Shares = (250,000) / (7,500,000/10,000,000) = 333,333 Shares

- You note the significant disparities in ownership structure across notes despite investing at approximately the same time and vow that when you start angel investing, you will only invest with either a Discount and Cap or priced round.

- Post-Money Shares

- Fourth, you calculate the total Post-Money Shares, which will be used to calculate the shares for each party in the Series A.

- Post-Money Shares = (Pre-Money Shares - Unallocated Options + Noteholder Shares)/(1- Series A Ownership % - Post-Money Unallocated Option Pool Ownership Target %)

- Post-Money Shares = (10,000,000 - 500,000 + 1,875,000) / (1 - .2 - .5)

- Post-Money Shares = 11,375,000 / .65 = 17,500,000

- Option Pool Refresh

- Fifth, you calculate that because you need a 15% Post-$ Option Pool, you need to make some additions to the pool.

- Option Pool Addition = Post-Money Unallocated Option Pool Ownership Target % * Post-Money Shares

- Option Pool Addition = .15*17,500,000 = 2,125,000

- Note that this is in addition to the 1,000,000 shares already allocated to ensure that after all investment is done, the unallocated option pool is 15% of the fully diluted Post-Money shares.

- Series A Shares

- Sixth, you can calculate the number of shares that will be allocated to the Series A Preferred.

- Series A Preferred Shares = (Series A Ownership * Post-Money Shares) = .2*17.5M = 3.5M Shares

- Additional Share Authorization

- Finally, you make sure that your authorized share counts are updated to 20,000,000, 16M for Common and 4M for Series A Preferred to allow for the creation of all the additional shares you will need.

After all of that work, you and your higher priced lawyer get to the following cap table:

Now that you’ve got Ludicrous Investment’s capital, you feel as though Lovely Lemonade is well capitalized for the months to come! You are getting ready to announce your next celebrity lemonade tie up and expect sales to continue to increase!

In a follow up post, we will explore what happens when a down round occurs as well as a liquidation event, and how participation and preference impact each investor.